UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material | |

Aflac Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

| PAYMENT OF FILING FEE (CHECK | |||

| ☑ | No fee | ||

| ☐ | Fee paid previously with preliminary | ||

| ☐ | |||

Notice of

2022

of Shareholders and Proxy Statement

Monday, May 2, 2022 at 10 a.m. ET

About Aflac Incorporated

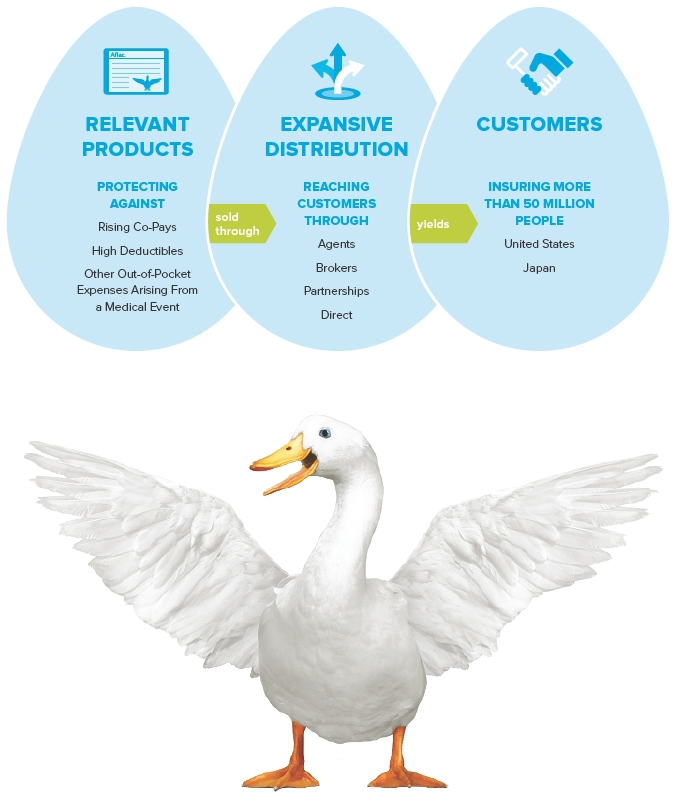

Aflac Incorporated (the “Company”), through its subsidiaries, provides financial protection to more than 50 million people worldwide. The Company’s principal business is supplemental health and life insurance products with the goal to provide customers the best value in supplemental insurance products in the United States (U.S.) and Japan.

In this Proxy Statement, the terms “Company,” “we,” or “our” refer to Aflac Incorporated. The Company’s insurance business consists of two reporting segments: Aflac Japan and Aflac U.S. The primary insurance subsidiary in the Aflac Japan segment is Aflac Life Insurance Japan Ltd. Aflac U.S. includes American Family Life Assurance Company of Columbus (Aflac); American Family Life Assurance Company of New York (Aflac New York), a wholly owned subsidiary of Aflac; Continental American Insurance Company (CAIC), branded as Aflac Group Insurance; and Tier One Insurance Company (TOIC); as well as Argus Dental & Vision, Inc. (Argus), a benefits management organization and national network dental and vision company. The term “PLADS” refers to the group premier life, absence management and disability solutions business that was acquired from Zurich North America by the Company, through its insurance subsidiaries Aflac and Aflac New York, in November of 2020. The term “Aflac Global Investments” refers to the Company’s asset management subsidiary, Aflac Asset Management LLC and its management subsidiary in Japan, Aflac Asset Management Japan Ltd.

For more than six decades, insurance policies of the Company’s subsidiaries have given policyholders the opportunity to focus on recovery, not financial stress. In the U.S., Aflac is the number one provider of voluntary/worksite insurance products. Aflac Japan is the leading provider of medical and cancer insurance in Japan, where it insures 1 in 4 households.

For more complete information regarding the Company’s 2021 performance, please review the Company’s Annual Report on Form 10-K for the year ended December 31, 2021.

Our Long-Term Growth Strategy

| 2022 PROXY STATEMENT | 1 |

NOTICE OF 2022 ANNUAL MEETING OF SHAREHOLDERS

Notice of 2020 Annual Meeting of Shareholders

You are cordially invited to attend the Annual Meeting of Shareholders (“Annual Meeting”) of Aflac Incorporated (the “Company”). This year’s Annual Meeting will be a completely “virtual meeting” of shareholders.

You will be able to attend the Annual Meeting, vote, and submit your questions during the webcast. The Annual Meeting will be held for the following purposes, all of which are described in the accompanying Proxy Statement:

|

|  |

|  |

| |

| FOR |

| each of the eleven director nominees

| |||||||||

| Proposal 2 |  | FOR | ||||||||

| To consider a non-binding advisory proposal on theCompany’s executive compensation (“say-on-pay”) |  See page 37. See page 37. | |||||||||

| Proposal 3 |  | FOR | ||||||||

| To ratify the appointment of KPMG LLP as theCompany’s independent registered public accountingfirm for the year ending December 31, |  See page 70. See page 70. | |||||||||

|  |

|  |  | ||||||

|

|

|

| |||||||

In addition, any other business properly presented may be acted upon at the meeting and at any adjournments or postponements of the meeting.

HowThe accompanying proxy is solicited by the Company’s Board of Directors on behalf of the Company. The Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, are enclosed.(2) The record date for determining which shareholders are entitled to Votevote at the Annual Meeting is February 22, 2022. Only shareholders of record at the close of business on that date will be entitled to vote at the Annual Meeting and any adjournment thereof. For more information on how to attend the virtual Annual Meeting, please see Appendix B of the Proxy Statement.

ItYour vote is important thatimportant! Even if you expect to attend the virtual Annual Meeting, please vote in advance. If you attend the Annual Meeting online, you may revoke your shares. proxy by submitting a vote during the Annual Meeting.

We offer several easyare making the Proxy Statement and cost-effective voting methods for your convenience.the form of proxy first available on or about March 17, 2022.

|  | ||

| |||

|  | ||

J. Matthew Loudermilk | (1) | We continue to monitor developments regarding the coronavirus (COVID-19). In the interest of the health and well-being of our shareholders, the Annual Meeting will be held solely by means of remote communication. | |

| (2) | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 2, 2022: This Proxy Statement and the Annual Report are available at proxyvote.com. |

Your vote is important! Even if you expect to attend the Annual Meeting, please vote in advance. If you attend the Annual Meeting, you may revoke your proxy and vote in person.

By order of the Board of Directors,

J. Matthew LoudermilkSecretaryMarch 19, 2020Columbus, Georgia

|

Scan the | |

| ||

2020 Proxy Statement iii

| 2 | AFLAC INCORPORATED |

LETTER FROM THE CHAIRMAN

AND CHIEF EXECUTIVE OFFICER

MARCH 19, 2020March 17, 2022

Dear Fellow Shareholder:

Considering what the global and national business landscape has experienced over the last two years, I think Aflac has benefited from some tailwinds, while simultaneously working hard to achieve our objectives and continue our strong earnings performance. I want to thank you, |

Pandemic or no pandemic, people are facing the same illnesses, accidents, and health conditions every day, only now COVID-19 has been added. This means that the need for our products is even greater now. We are committed to being there for them in their time of need with the financial Even amid the challenges of

While sales were impacted considerably in both Japan and the U.S. due to constrained face-to-face opportunities because of pandemic conditions, we maintained forward motion and adapted through virtual technology and seized the opportunity to accelerate investment in our platform, while continuing our strong earnings performance. We have been, and will continue to, concentrate on integrating the acquisitions we have made, particularly Aflac Network Dental and Vision and group premier life, absence management, and disability solutions benefits business (which we now refer to as PLADS). While focused on driving our core growth | platforms of Aflac Network Dental and Vision and PLADS, we look forward to participating in the growing demand for pet insurance through our alliance with Trupanion. We are pleased with our ownership stake with Trupanion, which has been an excellent investment. In 2021, Aflac Incorporated generated Strategic Capital Deployment

|

| LETTER FROM THE CHAIRMAN AND CHIEF EXECUTIVE OFFICER | 2022 PROXY STATEMENT | 3 |

liquidity position, which allowed us to confidently repurchase $2.3 billion, or 43.3 million of our shares, in

|

| ||

iv Aflac Incorporated

Even while the world continues to change in surprising ways, our values as a company remain steadfast. Doing the right thing is embodied in The Aflac Way, which is woven into the actions of those who represent the Company everywhere. One of the seven commitments of the Aflac Way, “Treat Everyone with Respect and Care,” is a fundamental element of who we are. I am proud to say that this commitment was honored time and time again in 2021. We believe | enhances our ability to respond to all of our Our commitment to

In closing, I | because that is not only what sets us apart, it’s just who we are. With his upcoming retirement from the Board on May 2, 2022, I would like to take this opportunity to express my gratitude to Mel Stith for his decade of dedicated service to the Company. With these updates as a backdrop, it is my pleasure to invite you to virtually attend the 2022 Annual Meeting of Shareholders on Monday, May 2, 2022, where you can learn more about Aflac Incorporated’s recent business performance and strategy for the future. I encourage you to review the enclosed proxy materials and Annual Report on Form 10-K as well as Aflac Incorporated’s 2021 Business and Sustainability Report, which can be found at investors.aflac.com under the “Sustainability” tab, to learn more about our company and our latest accomplishments. Then, please vote your shares, even if you plan to attend the virtual Annual Meeting. We want to be sure your shares and your viewpoints are represented. Sincerely,

Daniel P. Amos CHAIRMAN AND CHIEF  |

|

| 4 | |

| AFLAC INCORPORATED |

2020 Proxy Statement v

LETTER FROM THE LEAD

NON-MANAGEMENT DIRECTOR

MARCH 19, 2020March 17, 2022

To My Fellow Shareholders:

I am

|

| ||

vi Aflac Incorporated

The Just as we promote diversity within our Company operations, we foster diversity and well-rounded expertise | perspective, while newer members offer fresh viewpoints. Collectively, the relevant insights of the Board stem from experience in numerous areas, including public health, cybersecurity, investment and finance, insurance, the Japanese market, regulatory and risk management, and marketing and public relations. This breadth of expertise and diversity, combined with depth of skill and experience, has In preparation for the void created by Dr. Stith retiring from the Board with his long-tenured expertise, we believe we found an excellent candidate in Art Collins, who brings over 30 years of experience as a trusted advisor and strategist. Together, the team aligned again in 2021 to ensure proper oversight and that management was fully engaged in taking care of stakeholders including the communities we serve. For example, the Board leveraged our expertise in IT and cybersecurity that helped oversee the acceleration of virtual technology and protected sensitive information Corporate Finance and Investments In 2021, our investment portfolio was advantaged by several key activities. These included: expanding into new asset classes that contributed to diversified risk-adjusted excess returns. We also placed strategic equity investments in specialized asset classes and ESG investments. | Additionally, Aflac Incorporated became a signatory to Principles for Responsible Investment (PRI), underscoring our commitment to incorporating ESG issues into our investment and ownership decisions. Strategic Corporate Development As we seek to fill the needs of consumers, businesses and our distribution, we will continue to integrate the acquisitions we have made for the Aflac U.S. product portfolio with Aflac Network Dental and Vision and PLADS. These new lines modestly impact the top line in the short term. Along with our core products, they also better position Aflac U.S. for future long-term success. We were also pleased with the distribution alliance and ownership stake with Trupanion, which has been an excellent investment and a good distribution opportunity for the future. Commitment To Sustainability Aflac Incorporated’s corporate purpose was defined many years ago. At that time, we thought of it as doing the right thing, and now it is known as ESG. To help us quantify our longstanding approach, the Board’s Corporate Social Responsibility and Sustainability Committee has recommended to the Compensation Committee an ESG compensation modifier for 2021 that would impact officers. This compensation modifier encompasses responsible investing, carbon neutrality/net zero, diversity & inclusion, our sustainability bond, and advance reporting and disclosure. We are committing this |

| LETTER FROM THE LEAD NON-MANAGEMENT DIRECTOR | 2022 PROXY STATEMENT | 5 |

year to expanding our carbon emissions goal to be carbon neutral and net zero emissions by 2040 and 2050, respectively. This global net-zero climate commitment will demand a comprehensive and transparent approach, and thus we will provide appropriate reporting and hold ourselves accountable along the way. We have enhanced our disclosure in other meaningful ways this past year by posting online our approach to ESG Investing, Tax, Carbon Neutrality, Human Rights, Human Capital Management, Diversity and Inclusion, Supply Chain Approach and Philosophy, and Cybersecurity. Visit investors.aflac.com and click on the “Sustainability” tab, for these and additional disclosures that are aligned with our spirit of transparency and clarity on where we stand as a Company. We are proud our efforts to increase our transparency and improve our sustainability have received external recognition. | In 2021, in addition to becoming a signatory to Principles for Responsible Investment (PRI), Aflac Incorporated was included on the Dow Jones Sustainability North America Index. In 2022, Aflac was also recognized by Ethisphere as one of the World’s Most Ethical Companies for the 16th consecutive year, remaining the only insurance company in the world to receive this honor every year since this award was first introduced in 2007, and for the third consecutive year, was recognized on Bloomberg’s Gender-Equality Index, which tracks the financial performance of public companies committed to supporting gender equality through policy development, representation, and transparency. As lead director, I will continue interacting and engaging with our investors, gaining insight into their perspectives, and considering the viewpoints and positions of those who invest in our business. | The Board looks forward to continuing its ongoing dialogue with investors and acting upon that feedback, and we thank you for your support and the privilege of representing you and your shares in Aflac Incorporated. With these vital topics in mind, I encourage you to review the accompanying Proxy Statement and associated materials and to vote your shares before our

Sincerely,

W. Paul Bowers LEAD NON-MANAGEMENT  |

|

| 6 | AFLAC INCORPORATED |

| 2022 PROXY STATEMENT | |

| 7 |

2020 Proxy Statement vii

This summary highlights information contained elsewhere in this Proxy Statement, but it does not contain all of the information you should consider. For more information, please refer to the following:

AGENDA AND VOTING MATTERS

|

|  |

| |

|

| |||

|

|  |

| |

|

| |||

|

|  |

| |

|

|

Please read the entire Proxy Statement before voting. This Proxy Statement and the accompanying proxy are being delivered to shareholders on or about March 19, 2020.

For more complete information regarding the Company’s 2019 performance, please review the Company’s Annual Report on Form 10-K. In this Proxy Statement, the terms “Company,” “we,” or “our” refer to Aflac Incorporated. The term “Aflac” refers to the Company’s subsidiary, American Family Life Assurance Company of Columbus. The term “Aflac U.S.” refers collectively to the Company’s United States insurance subsidiaries: Aflac; American Family Life Assurance Company of New York (Aflac New York), a wholly owned subsidiary of Aflac; and Continental American Insurance Company (CAIC), branded as Aflac Group Insurance. The term “Aflac Japan” refers to Aflac Life Insurance Japan Ltd.

viii Aflac Incorporated

Proxy Summary

| | ||||

Each Director stands for election annually. The following provides summary information about the nominees. Our Board believes it is appropriate to maintain a diverse balance of longer tenured members, who bring stability and valuable Company-specific knowledge with a historical perspective, and newer members, who bring fresh viewpoints and new ideas. | ||||

| The Board of Directors recommends a vote |  |

| |

DIRECTOR NOMINEES.

| Committee Memberships | |||||||||||

| Name | IND | Age | Director Since | AR | C | CD | CG | E | FI | CSR | |

| DANIEL P. AMOS Chairman and Chief Executive Officer, Aflac Incorporated | 68 | 1983 | ● | ● | ||||||

| W. PAUL BOWERS Lead Director Chairman, President and Chief Executive Officer of Georgia Power Co. | ● | 63 | 2013 | ● | ● | ● | ● | |||

| TOSHIHIKO FUKUZAWA President and CEO, Chuo Real Estate Co., Ltd. | ● | 63 | 2016 | ● | ||||||

| THOMAS J. KENNY Former Partner and Co-Head of Global Fixed Income, Goldman Sachs Asset Management | ● | 56 | 2015 | ● | ● | ● | ||||

| GEORGETTE D. KISER Operating Executive, The Carlyle Group | ● | 52 | 2019 | ● | ||||||

| KAROLE F. LLOYD Certified Public Accountant and retired Ernst & Young LLP audit partner | ● | 61 | 2017 | ● | ● | ● | ||||

| NOBUCHIKA MORI Representative Director, Japan Financial and Economic Research Co. Ltd. | ● | 63 | * | |||||||

| JOSEPH L. MOSKOWITZ Retired Executive Vice President, Primerica, Inc. | ● | 66 | 2015 | ● | ● | ● | ||||

| BARBARA K. RIMER, DrPH Dean and Alumni Distinguished Professor, Gillings School of Global Public Health, University of North Carolina, Chapel Hill | ● | 71 | 1995 | ● | ● | |||||

| KATHERINE T. ROHRER Vice Provost Emeritus, Princeton University | ● | 66 | 2017 | ● | ● | |||||

| MELVIN T. STITH Dean Emeritus of the Martin J. Whitman School of Management at Syracuse University | ● | 73 | 2012 | ● | ● | ● | ||||

2020 Proxy Statement ix

Table of Contents PROPOSAL 2

Proxy Summary

CORPORATE GOVERNANCE HIGHLIGHTS

CORPORATE SOCIAL RESPONSIBILITY AND SUSTAINABILITY HIGHLIGHTS

We are proud of the accolades we have received, a handful of which are listed below, and we invite you to read Aflac’s Year in Review and Corporate Social Responsibility reports to learn more about our initiatives.

x Aflac Incorporated

Proxy Summary

Executive Compensation (“Say-on-Pay”) | ||||

We are committed to achieving a high level of total return for our shareholders. From the end of August 1990, when Daniel P. Amos was appointed the CEO, through December 31, | ||||

| The Board of Directors recommends a vote FOR

| |||

PROPOSAL 3 Ratification of Auditors In February 2022, the Audit and Risk Committee voted to appoint KPMG LLP, an independent registered public accounting firm, to perform the annual audit of the Company’s consolidated financial statements for fiscal year 2022, subject to ratification by its shareholders. The Board of Directors and the Audit and Risk

Please read the entire Proxy Statement before voting. This Proxy Statement and the accompanying proxy were first sent or made available to shareholders on or about March 17, 2022. | ||||

| 8 |  |

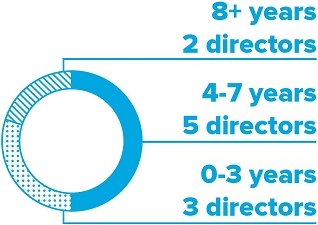

Board Tenure 2022 Independent Director nominees (10) | |||||||

KATHERINE T. ROHRER, 68 Vice Provost Emeritus, Director Since 2017 Committees: C, CG | 3 0-3 Years | 5 4-7 Years | 2 8+ Years | ||||

| Committee Key | |||||

AR C Compensation CD Corporate Development CG Corporate Governance CSR Corporate Social Responsibility & Sustainability E Executive FI Finance & Investment ● Chair | BARBARA K. RIMER, DrPH, 73 Dean and Alumni Distinguished Professor, Gillings School of Global Public Health, University of North Carolina, Chapel Hill Director Since 1995 Committees: CG, CSR | JOSEPH L. MOSKOWITZ, 68 Retired Executive Vice Director Since 2015 Committees: AR, C, CD, E |

Diversity of Skills, Experience And Attributes 2022 all Director nominees (11) |

| 91% | 37% | 18% | 45% | 91% | 82% | ||||||

| Independent | Current or Former CEO | Marketing and Public Relations | Japanese Market Expertise | Invest. and Financial Expertise | Operations Experience | ||||||

| 91% | 64% | 18% | 37% | 36% | 36% | ||||||

| Reg. and Risk Mgmt. Experience | Industry Experience | Public Health Experience | Digital/ Cybersecurity | Woman Director | Directors of Color |

| VOTING ROADMAP | 2022 PROXY STATEMENT | 9 |

| TOSHIHIKO FUKUZAWA, 65 | THOMAS J. KENNY, 58 | |||

Deputy President and Representative Director, Chuo-Nittochi Co., Ltd. Director Since 2016 Committees: FI | Former Partner and Co-Head of Global Fixed Income, Goldman Sachs Asset Management Director Since 2015 Committees: CD, CSR, FI |

| 7 of 10 | |||||

| Independent | Independent Director | ||||

GEORGETTE D. KISER, 54 Operating Executive, The Carlyle Group Director Since 2019 Committees: AR, C |

| NOBUCHIKA MORI, 65 | KAROLE F. LLOYD, 63 | |||

Representative Director, Director Since 2020 Committees: CG | Certified Public Accountant and retired Ernst & Young LLP audit Partner Director Since 2017 Committees: AR, E, FI |

| 10 | AFLAC INCORPORATED | VOTING ROADMAP |

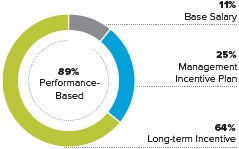

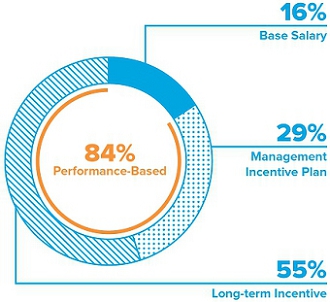

Our executive compensation philosophy is to provide pay that is aligned with the Company’s results. We believe this is the most effective method for creating shareholder value and it has played a significant role in making the Company an industry leader. Our pay-for-performance compensation program is designed to align pay and performance and generally targets market median positioning and delivers the majority of direct compensation through performance-based elements. This ensures proper alignment with our shareholders and ties compensation for named executive officers to the Company’s performance.

The Company’s executive compensation program reflects our corporate governance best practices principles:

● The Board’s independent Compensation Committee oversees the program. | ||

| The Compensation Committee retains an independent compensation consultant that reports only to that Committee. | |

| The independent compensation consultant briefs the full Board annually on CEO pay and performance alignment. | |

● All employees are prohibited from hedging Company stock. ● Executive officers and Directors may not enter into 10b5-1 plans unless approved by the Compensation Committee or pledge the Company’s stock. ● We do not provide change-in-control excise tax gross-ups. ● All employment agreements contain double trigger change-in- control requirements. | ||

● We have had a clawback policy since 2007. ● We were the first public company in the U.S. to voluntarily provide shareholders with a say-on-pay vote – three years before such votes became mandatory. ● Executive officers and Directors have been subject to stock ownership guidelines for almost two | ||

The continued effect of COVID-19 created unplanned volatility in our 2021 results for the Aflac U.S. and Aflac Japan segments.

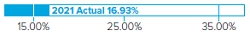

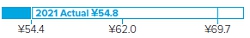

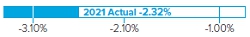

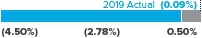

| ● | Aflac U.S. and Aflac Japan new annualized premium sales(1) increased by 16.9% and 7.7%, respectively. The Japan sales |

| ● | Total revenues |

| ● |

| * | Adjusted earnings per diluted share excluding foreign currency impact, total adjusted revenues, |

| (1) | As |

2020 Proxy Statement xi

Proxy Summary

The total target direct compensation mix for 2019 for (1) our CEO and (2) our CEO together with our other NEOs is illustrated in the following charts, and reflects the performance-based nature of our compensation program:

|  |

We are pleased that, for the past two consecutive years, 96% of our shareholders voting on the say-on-pay proposal voted in favor of our executive compensation. We believe this continued support reflects favorably on changes we have made to our executive compensation program over the past few years to more tightly link compensation metrics to our business strategy while incorporating feedback received from our shareholders. We work hard to ensure we implement best practices in executive compensation while staying focused on performance-based program elements that align with shareholder interests. We will continue to review our compensation program each year to determine if additional changes are warranted.

|

11 | ||||

| AFLAC INCORPORATED | VOTING ROADMAP |

|  |

|

xii Aflac Incorporated

2020 Proxy Statement 1

| ||

| ||

| ||

| ● | Reduced combined Scope 1 and 2 greenhouse gas emissions by more than 70% from 2007 to 2020 | |

| ● | Expect 2021 to be the 2nd consecutive year for being carbon neutral for Scopes 1 and 2 emissions | |

| ● | Goal of |

We carefully consider |

We are proud of the |

|  | ||

| Principles for ResponsibleInvestment (PRI) Signatory | Dow Jones Sustainability Index NorthAmerica (8th year), | ||

| In 2021, Aflac Incorporated became a United Nations PRI Signatory, which works to understand the investment implications of ESG factors and to support its international network of investor signatories in incorporating these factors into investment and ownership decisions. | noting that the Company received high marks for its Board Diversity Policy, IT Security/Cybersecurity Measures and Climate Change Strategy | ||

|  | ||

| Fortune’s Most Admired Companies (21st year), | Forbes Best Employers for Diversity, | ||

| ranking No. 1 in the Long-Term Investment Value category in the Insurance: Life and Health Industry and No. 2 for innovation | which considers evaluation of diverse boards and executive ranks and proactive diversity and inclusion initiatives | ||

|  | ||

| Ethisphere’s World’s Most Ethical Companies (16th consecutive year), | Bloomberg’s Gender-Equality Index (3rd consecutive year), | ||

| making it the only insurance company to hold this distinction every year since the inception of the honor in 2007. | which tracks the financial performance of public companies committed to supporting gender equality through policy development, representation, and transparency |

Workforce Diversity

| ● | As of December 31, 2021, women accounted for 56% of Aflac Japan employees, including part-time employees, and 33% of leadership roles. Women also held 23% of management roles, as part of Aflac Japan’s longer-term plan to increase this percentage to 30% by 2025. | |

| ● | As of December 31, 2021, 49% of Aflac U.S. and the Company employees located in the U.S. were people of color and 66% were women. Women also occupied 49% of leadership roles located in the U.S. and 28% of senior management roles. In 2021, 64% of new hires located in the U.S. were people of color and 76% were women. |

Community Investment and Philanthropy

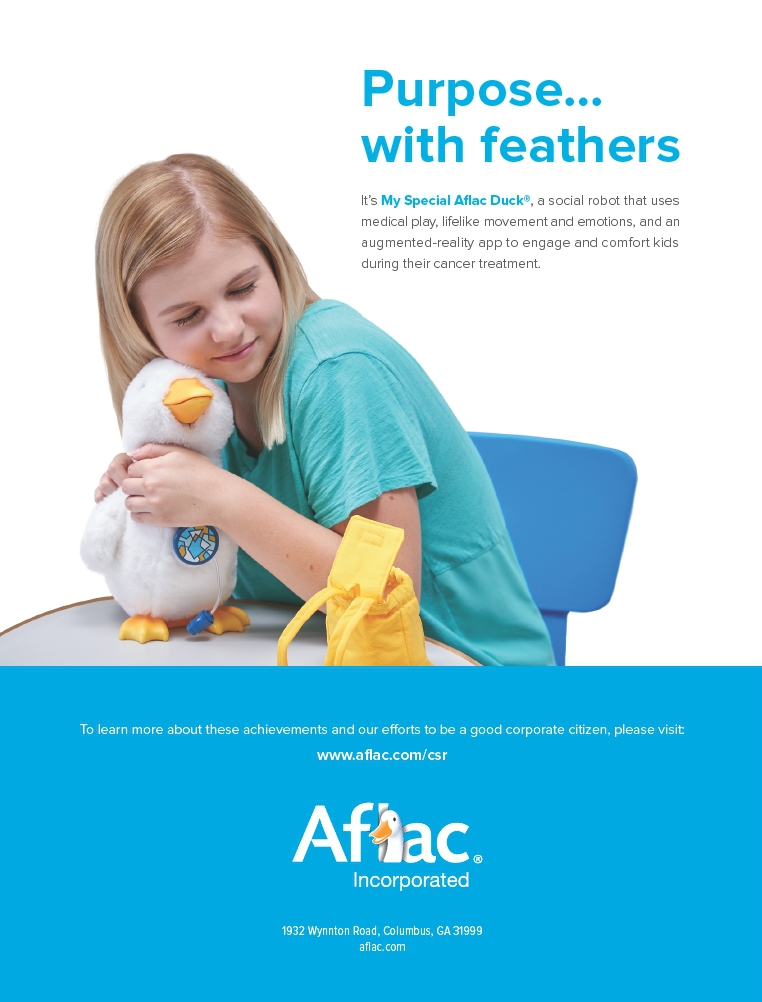

| ● | My Special Aflac Duck® (MSAD) is a “smart” robotic companion designed to help children cope with their cancer and sickle cell treatments. Aflac aims to put a MSAD in the hands of every child, age 3 and above, diagnosed with cancer in the U.S., Japan and Northern Ireland and has given MSADs to over 13,000 children through 2021. | ||

| ● | Aflac and its employees and agents are responsible for: | ||

| - | 140,000 pediatric patients and their family members who have called Aflac Parents House a home-away-from-home while receiving treatment for serious illnesses, like cancer. | ||

| - | $157 million in support of Aflac Cancer and Blood Disorders Center of Children’s Healthcare of Atlanta, helping make it one of the top pediatric cancer programs in the United States by U.S. News and World Report. | ||

| 2022 PROXY STATEMENT | 13 |

Election of Directors

Each Director stands for election annually. The following provides summary information about the nominees. Our Board believes it is appropriate to maintain a diverse balance of longer tenured members, who bring stability and valuable Company-specific knowledge with a historical perspective, and newer members, who bring fresh viewpoints and new ideas.

The Board of Directors recommends

a vote FOR each of the eleven nominees

named in this proxy statement.

The Company proposes that the following eleven individuals be elected to the Board. These individuals have been nominated by the Board’s Corporate Governance Committee. If elected, they are willing to serve for a one-year term expiring at our 20212023 Annual Meeting of Shareholders. Each Director will hold office until his or her successor has been elected and qualified or until the Director’s earlier death, resignation or removal. The people named in the accompanying proxy (or their substitutes) will vote to elect these nominees unless specifically instructed to the contrary. However, if any nominee becomes unable or unwilling to serve or is otherwise unavailable for election, the people named in the proxy (or their substitutes) will have discretionary authority to vote or to refrain from voting on any substitute nominee. The Board has no reason to believe that any of the nominees will be unable or unwilling to serve.serve if elected.

All butexcept for one of the nominees are currently members of our Board. Upon the recommendation of the Corporate Governance Committee, Mr. Nobuchika MoriArthur R. Collins has been nominated to serve on the Board. Mr. MoriCollins was recommended for the Board by the Chairman of the Board most notablyDr. Melvin T. Stith for his expertise in governmental affairs and regulatory expertisematters, as well as his overall business acumen and financial acumen gathered over a three-plus decade career in Japan and internationally as a financial regulator, including from July 2015-July 2018, as Commissioner of Japan’s Financial Services Agency.experience.

We expect all of our Directors to have a demonstrated ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company. As shown below and on the following pages, our nominees have a range of skills and experience in areas that are critical to our industry and our operations.

2 Aflac Incorporated

Corporate Governance Matters

Director Skills Summary and The Link to Our Strategy

| 14 | AFLAC INCORPORATED | CORPORATE GOVERNANCE MATTERS |

Daniel P. Amos CHAIRMAN AND CHIEF

|  | W. Paul Bowers RETIRED CHAIRMAN AND CHIEF LEAD NON-MANAGEMENT DIRECTOR |  | |||||||

| AGE | DIRECTOR SINCE | COMMITTEES | AGE | DIRECTOR SINCE | COMMITTEES | |||||

| 70 | 1983 | E FI | 65 | 2013 | AR* CD CSR E | |||||

Mr. Amos has been Chief Executive Officer of the Company and Aflac since 1990, Chairman since 2001, was President of Aflac from July 2017 to May 2018, and was President of Aflac Incorporated from February 2018 through December 2019. He has spent 40 years in various positions at Aflac. Skills and Recognition Mr. Amos’ experience and approach deliver insightful expertise and guidance to the Board of Directors on topics relating to corporate governance, people management, and risk management. Institutional Investor magazine has named Mr. Amos one of America’s Best CEOs in the life insurance category five times. Harvard Business Review has named Mr. Amos among the World’s Best Performing CEOs in each of the past four years. CR Magazine recently honored him with a Lifetime Achievement Award for his dedication to corporate responsibility. Other Board or Leadership Positions, Professional Memberships or Awards ● Synovus Financial Corp. (2001-2011) ● Southern Company (2000-2006) | Mr. Bowers retired as chairman and chief executive officer of Georgia Power, the largest subsidiary of Southern Company, a gas and electricity utility holding company, on July 1, 2021, a position that he held since 2011. He also served as president of Georgia Power from 2011 until November 2020. Before that, Mr. Bowers served as chief financial officer of Southern Company from 2008 to 2010. Previously, he served in various senior executive positions across Southern Company in Southern Company Generation, Southern Power, and the company’s former U.K. subsidiary, where he was president and chief executive officer of South Western Electricity LLC/Western Power Distribution. Skills and Recognition Mr. Bowers brings to the Board a valuable and unique perspective from his considerable financial knowledge, national and international business experience operating in a highly regulated industry, and expertise in corporate development and managing the evolving risks associated with cybersecurity. Other Board or Leadership Positions, Professional Memberships or Awards ● Chair, Atlanta Committee for Progress (2016) ● Nuclear Electric Insurance Ltd. (since 2009); Chairman (2017-2019) ● Board of Regents of the University System of Georgia (2014-2018) ● Federal Reserve Bank of Atlanta’s Energy Policy Council (2008-2018) ● Brand Industrial Holding, Inc. (since 2019) and Audit Committee Chair (since 2019) ● Exelon Corporation (since 2021) ● Audit Committee and Corporate Governance Committee (since 2022)

| |||||||||

| LEGEND: | ||||||||||

| * Financial Expert ● AR Audit and Risk ● C Compensation ● CD Corporate Development ● CG Corporate Governance | ||||||||||

CSR Corporate Social Responsibility and Sustainability ● E Executive ● FI Finance and Investment ● Independent ● Independent ● Chair ● Chair ● Member Member | ||||||||||

| CORPORATE GOVERNANCE MATTERS | 2022 PROXY STATEMENT | 15 |

Arthur R. Collins FOUNDER AND MANAGING

|  | Toshihiko Fukuzawa DEPUTY PRESIDENT AND |  | |||||||

| AGE | DIRECTOR NOMINEE | AGE | DIRECTOR SINCE | COMMITTEES | ||||||

| 61 | 65 | 2016 | FI | |||||||

Mr. Collins is the founder and managing partner of theGROUP, a government relations and strategic communications consulting firm. Prior to founding theGROUP in 2011, Mr. Collins was Chairman and CEO of Public Private Partnership, Inc., which he established in 1989. Mr. Collins is an experienced and trusted strategic advisor to corporate leaders and domestic and foreign governments with concentrations in real estate, healthcare, and global public policy. His additional areas of expertise include financial services, trade, energy, information technology, consumer products, agriculture, transportation, manufacturing, and national security. Skills and Recognition Mr. Collins has more than 30 years of experience as a trusted advisor and strategist providing counsel to corporate leaders, heads of state and their governments, and non-profit executives and their boards. He will bring his expertise in governmental affairs and regulatory matters, as well as his overall business acumen and experience, to our Board. Other Board or Leadership Positions, Professional Memberships or Awards ● KB Home (since 2020) ● Audit Committee ● RLJ Lodging Trust (since 2016) ● Compensation, Nominating and Corporate Governance Committees ● Vice Chair, Brookings Institution Board of Trustees (since 2014) ● Chairman, Morehouse School of Medicine Board of Trustees (since 2009) ● Member, Meridian International Center Board of Trustees (2009-2017) ● Chairman, Florida A&M University Board of Trustees (2001-2003) | Mr. Fukuzawa has been the deputy president and representative director of Chuo-Nittochi Co., Ltd., a real estate development and leasing company in Japan, since April 2021. Previously, he was the president and chief executive officer of Chuo Real Estate Co., Ltd., from July 2018 to March 2021, and was the president and chief executive officer of Yushu Tatemono Co., Ltd., from June 2015 to June 2018, which are both real estate development and leasing companies in Japan. He served as deputy president at Mizuho Trust & Banking Co., Ltd. from April 2013 to March 2015, managing executive officer and head of the IT System Group at Mizuho Bank Ltd. from June 2011 to March 2013, and deputy president at Mizuho Information & Research Institute from June 2009 to June 2011. From 2002 to 2009, he held executive officer and general manager positions at Mizuho Bank, Ltd., part of Mizuho Financial Group, Inc. Prior to 2002, Mr. Fukuzawa held various positions of increasing responsibility at Dai-Ichi Kangyo Bank, Ltd., which he joined in 1979. Skills and Recognition Over a 36-year career as a professional banker in Japan, Mr. Fukuzawa gained extensive business and IT knowledge and experience with a wide range of Japanese financial services institutions, including insurance companies. He provides the Board with valuable insight and expertise relevant to the Company’s Japanese business.

| |||||||||

| LEGEND: | ||||||||||

| * Financial Expert ● AR Audit and Risk ● C Compensation ● CD Corporate Development ● CG Corporate Governance | ||||||||||

CSR Corporate Social Responsibility and Sustainability ● E Executive ● FI Finance and Investment ● Independent ● Independent ● Chair ● Chair ● Member Member | ||||||||||

| 16 | AFLAC INCORPORATED | CORPORATE GOVERNANCE MATTERS |

Thomas J. Kenny FORMER PARTNER AND CO-HEAD OF

|  | Georgette D. Kiser OPERATING EXECUTIVE, THE |  | |||||||

| AGE | DIRECTOR SINCE | COMMITTEES | AGE | DIRECTOR SINCE | COMMITTEES | |||||

| 58 | 2015 | CD CSR FI | 54 | 2019 | AR* C | |||||

Mr. Kenny has served as a trustee of TIAA-CREF, a financial services organization, since 2011. He currently serves as the Chair of the TIAA-CREF Funds Board of Trustees, previously served as Chair of the Investment Committee, and also currently sits on the TIAA-CREF Funds Audit and Compliance, Investment and Nominating and Governance Committees. Prior to his role at TIAA-CREF, Mr. Kenny held a variety of leadership positions at Goldman Sachs for twelve years, most recently serving as partner and advisory director. He also served as co-head of the Global Cash and Fixed Income Portfolio team at Goldman Sachs Asset Management, where he was responsible for overseeing the management of more than $600 billion in assets across multiple strategies with teams in London, Tokyo, and New York. Before joining Goldman Sachs, Mr. Kenny spent thirteen years at Franklin Templeton. He is a CFA charter holder. Skills and Recognition Mr. Kenny’s extensive experience in investment management and financial markets provides the Board with valuable insight and expertise. Other Board or Leadership Positions, Professional Memberships or Awards ● CREF Board of Trustees, Chairman (since 2017) ● TIAA-CREF Fund Complex: ● Executive Committee, Chair (since 2017) ● Investment Committee (since 2011) ● Audit and Compliance Committee (since 2018) ● Nominating and Governance Committee (since 2017) ● Ad Hoc CREF Special Projects Committee (since 2020) | Ms. Kiser is an Operating Executive at The Carlyle Group, a global alternative asset management firm, where she advises Carlyle professionals through the investment process, from sourcing deals, conducting diligence, managing companies and exiting transactions. She also helps set IT strategy for Carlyle Portfolio companies and drives IT/digital diligence and advisory efforts. In addition, Ms. Kiser serves as an independent advisor who helps lead due diligence and technical strategies across various middle market private equity and venture capital firms. Previously, she was a managing director and chief information officer at The Carlyle Group, where she was responsible for leading the firm’s global technology and solutions organization from February 2015 until May 2019. In this role, Ms. Kiser developed and drove information technology strategies across the global enterprise, which includes the firm’s application development, data, digital, infrastructure, cybersecurity, and program management and outsourcing activities. She also led teams that provided creative solutions for investment front office, trading, and back-office operations at T. Rowe Price. Prior to T. Rowe Price, she worked for General Electric within their aerospace unit. Skills and Recognition Throughout Ms. Kiser’s three-plus decade career, she has established extensive experience and success developing and leading talented teams to deliver decision support systems and technical solutions, including cybersecurity, for financial services firms. She has consistently been recognized for bringing credibility to solutions and technical organizations in addition to building strong business partnerships, leveraging human and technical resources, implementing investment and customer management systems, and producing advanced data management solutions. Other Board or Leadership Positions, Professional Memberships or Awards ● Jacobs Engineering (since 2019) ● Adtalem Global Education (since 2018) ● NCR Corporation (since 2020) ● Brown Advisory Board mutual fund (since 2022)

| |||||||||

| LEGEND: | ||||||||||

| * Financial Expert ● AR Audit and Risk ● C Compensation ● CD Corporate Development ● CG Corporate Governance | ||||||||||

CSR Corporate Social Responsibility and Sustainability ● E Executive ● FI Finance and Investment ● Independent ● Independent ● Chair ● Chair ● Member Member | ||||||||||

| CORPORATE GOVERNANCE MATTERS | 2022 PROXY STATEMENT | 17 |

Karole F. Lloyd CERTIFIED PUBLIC ACCOUNTANT

|  | Nobuchika Mori REPRESENTATIVE DIRECTOR, |  | |||||||

| AGE | DIRECTOR SINCE | COMMITTEES | AGE | DIRECTOR SINCE | COMMITTEES | |||||

| 63 | 2017 | AR* E FI | 65 | 2020 | CG | |||||

Ms. Lloyd is a certified public accountant and retired as vice chair and regional managing partner for Ernst & Young, LLP (“EY”), a global accounting firm, in December 2016. She brings more than 37 years of work experience and leadership, most recently as part of the US Executive Board, Americas Operating Executive and the Global Practice Group for EY, and has extensive experience in the audits of large financial services, insurance, and health care companies. Ms. Lloyd served many of EY’s highest profile clients through mergers, IPOs, acquisitions, divestitures, and across numerous industries including banking, insurance, consumer products, transportation, real estate, manufacturing, and retail. She has served as an audit partner for publicly held companies in both the United States and Canada. Ms. Lloyd’s other experience includes leadership and consulting with respect to financial reporting, board governance and legal matters, regulatory compliance, internal audit, and risk management. Skills and Recognition Ms. Lloyd’s extensive accounting and advisory experience across the financial service industry, combined with her leadership skills and strategic thinking, provide valuable perspective for our Audit and Risk Committee. Other Board or Leadership Positions, Professional Memberships or Awards ● Churchill Downs Incorporated and Audit Committee (since 2018) ● The University of Alabama President’s Advisory Council (since 2003) ● The University of Alabama Board of Visitors for the Commerce and Business School (since 2001) ● Atlanta Symphony Orchestra Board of Directors (since 2010) ● Metro Atlanta Chamber of Commerce, Board of Trustees and Executive Committee (2009-2016) | Mr. Nobuchika Mori is representative director of the Japan Financial and Economic Research Co. Ltd., a research and consulting firm. In this role, he has been responsible for providing research and consulting services to companies in Japan and abroad since July 2018. He is currently also an adjunct professor and senior research scholar at Columbia University School of International and Public Affairs (since October 2018). From July 2015 until his retirement in July 2018, Mr. Mori served as commissioner of the Financial Services Agency of Japan (the “JFSA”), Japan’s integrated financial regulator. In this role, he led supervision of financial institutions including banks, securities firms and insurance companies, and directed legislative and regulatory planning to ensure financial stability and enhance economic growth in Japan. Before becoming the head of JFSA, he spent more than 30 years in senior positions at JFSA and Japan’s Ministry of Finance (the “MOF”), including JFSA Vice Commissioner for Policy Coordination, Director General for Inspection, and Director General for Supervision (July 2014 to July 2015). He also served in a range of diplomatic posts reflecting his expertise in international financial markets and regulatory standards, including as the Chief Representative in New York for the MOF, Minister of the Embassy of Japan in the United States of America, and as Deputy Treasurer at the Inter-American Development Bank. Skills and Recognition Over a three-plus decade career immersed in Japan’s finance industry as a financial regulator, policymaker, and standard setter in Japan and internationally, Mr. Mori gained extensive specialized economic, policy, and financial regulatory expertise, knowledge and experience. He brings to the Board indispensable, significant insight with respect to the Company’s Japanese business operations from his considerable financial and economic knowledge, international business experience, and regulatory acumen spanning highly regulated industries in Japan and internationally. Other Board or Leadership Positions, Professional Memberships or Awards ● Center on Japanese Economy and Business (CJEB) Professional Fellow (since 2018)

| |||||||||

| LEGEND: | ||||||||||

| * Financial Expert ● AR Audit and Risk ● C Compensation ● CD Corporate Development ● CG Corporate Governance | ||||||||||

CSR Corporate Social Responsibility and Sustainability ● E Executive ● FI Finance and Investment ● Independent ● Independent ● Chair ● Chair ● Member Member | ||||||||||

| 18 | AFLAC INCORPORATED | CORPORATE GOVERNANCE MATTERS |

Joseph L. Moskowitz RETIRED EXECUTIVE VICE

|  | Barbara K. Rimer, DrPH DEAN AND ALUMNI DISTINGUISHED |  | |||||||

| AGE | DIRECTOR SINCE | COMMITTEES | AGE | DIRECTOR SINCE | COMMITTEES | |||||

| 68 | 2015 | AR* C CD E | 73 | 1995 | CG CSR | |||||

Mr. Moskowitz retired from Primerica, Inc., an insurance and investments company, where he served as executive vice president from 2009 until 2014, leading the Product Economics and Financial Analysis Group. He joined Primerica in 1988, and served in various capacities, including managing the group responsible for financial budgeting, capital management support, earnings analysis, and analyst and stockholder communications support. He served as chief actuary from 1999 to 2004. Before joining Primerica, Mr. Moskowitz was vice president of Sun Life Insurance Company from 1985 to 1988 and was a senior manager at KPMG from 1979 to 1985. Skills and Recognition With forty years of actuarial experience and leadership roles in the financial services industry, Mr. Moskowitz provides insight into the analysis and evaluation of actuarial and financial models, which form the basis of various aspects of corporate planning, financial reporting, and risk assessment, to the Board. Other Board or Leadership Positions, Professional Memberships or Awards ● Fellow, Society of Actuaries (since 1979) ● Member, American Academy of Actuaries (since 1979) | Dr. Rimer has been dean of the University of North Carolina Gillings School of Global Public Health since 2005, and alumni distinguished professor since 2003. Previously, she was director of the Division of Cancer Control and Population Sciences at the National Cancer Institute. She is a former director of Cancer Control Research and professor of community and family medicine at the Duke University School of Medicine. She was elected to the Institute of Medicine in 2008. Skills and Recognition At the Gillings School of Public Health, Dr. Rimer works to improve public health, promote individual well-being, and eliminate health inequities across North Carolina and around the world. In 2012, Dr. Rimer was appointed Chairman of the President’s Cancer Panel remained in this capacity until she resigned in 2020. Her insight and leadership with respect to the public health sector are extremely relevant to the Company’s business and operations. Other Board or Leadership Positions, Professional Memberships or Awards ● Chair, President’s Cancer Panel (2012-2020) ● Elected to Institute of Medicine (2008) ● Awarded the American Cancer Society Medal of Honor (2013) ● University of North Carolina at Chapel Hill General Alumni Association’s Faculty Service Award (2020)

| |||||||||

| LEGEND: | ||||||||||

| * Financial Expert ● AR Audit and Risk ● C Compensation ● CD Corporate Development ● CG Corporate Governance | ||||||||||

CSR Corporate Social Responsibility and Sustainability ● E Executive ● FI Finance and Investment ● Independent ● Independent ● Chair ● Chair ● Member Member | ||||||||||

| CORPORATE GOVERNANCE MATTERS | 2022 PROXY STATEMENT | 19 |

| 20 | AFLAC INCORPORATED | CORPORATE GOVERNANCE MATTERS |

Board of Director Nominees Skills, Experience, and Diversity

|  |  |  |  |  |  |  |  |  |  | |

| Skills and Experience |  |  |  |  |  |  |  |  |  |  |  |

|

| ||||

| |||||

| |||||

2020 Proxy Statement 3

Corporate Governance Matters

|

| ||||

| |||||

| |||||

|

| ||||

| |||||

| |||||

4 Aflac Incorporated

Corporate Governance Matters

|

| ||||||||||||

| |||||||||||||

| INDEPENDENT |  |  |  |  |  |  |  |  |  |  | ||

| MARKETING AND PUBLIC RELATIONS |  | ||||||||||||

|

| ||||

| |||||

| |||||

2020 Proxy Statement 5

Corporate Governance Matters

|

| ||||

| |||||

| |||||

| CURRENT OR FORMER CEO |  |  |  | ||

|  |

| |||

| |||||

| |||||

6 Aflac Incorporated

Corporate Governance Matters

|

| |||||||

|  |  | ||||||

|  |  |  |  |  |  | ||

| JAPANESE MARKET EXPERIENCE |  |  | ||||||

|  |

| |||

| |||||

| |||||

2020 Proxy Statement 7

Corporate Governance Matters

|  |

| |||||||||

|  |  | |||||||||

|  |  |  |  |  |  |  | ||||

| REGULATORY AND RISK MGMT. EXPERIENCE |  |  |  |  |  |  |  |  |  |  | |

|  |  |  |

|  |  |  | ||||

| |||||||||||

| PUBLIC HEALTH EXPERIENCE | ||||||||||

|  | ||||||||||

| DIGITAL/CYBERSECURITY EXPERIENCE |  |  |  |  | |||||||

| Race/Ethnicity | |||||||||||

| WHITE |  |  |  |  |  |  |  | ||||

| BLACK OR AFRICAN AMERICAN |  |  | |||||||||

| ASIAN |  |  | |||||||||

| Gender | |||||||||||

| MALE |  |  |  |  |  |  |  | ||||

| FEMALE |  |  |  |  |

8 Aflac Incorporated

Corporate Governance Matters

Director Not Eligible for Re-election

Under the Company's Bylaws, Mr. Robert B. Johnson, who has turned 75 prior to our Annual Meeting, is not eligible to be nominated for re-election and, as a result, the Company has not nominated Mr. Johnson for election to the Board at the 2020 Annual Meeting. Mr. Johnson has served on our Board since 2002. We thank Mr. Johnson for his service to the Board.

Board Succession Planning and Refreshment Process

Our Board believes it is appropriate to maintain a diverse balance of longer tenured members, who bring stability and valuable Company-specific knowledge with a historical perspective, and newer members, who bring fresh viewpoints and new ideas. Our regular self-evaluation process ensures we maintain a cohesive, diverse, and well-constituted board of high integrity that exemplifies the right balance of perspectives, experience, independence, skill sets, and subject matter experts required for prudent oversight. Over the last five years, we have added sixfive new directors as we make it a priority to identify candidates with the skills needed to ensure effective oversight.

Board Changes since 2017

5 of 5

nominees appointed

in the last five years

are women and/or

people of color

Skills of Directors Joining the Board since 2017 | ||

| INVESTMENT AND FINANCIAL | |

| REGULATORY AND RISK MANAGEMENT | |

| PUBLIC HEALTH | |

| OPERATIONS | |

| JAPANESE MARKET | |

| INDUSTRY | |

| DIGITAL/CYBERSECURITY | |

| CORPORATE GOVERNANCE MATTERS | 2022 PROXY STATEMENT | 21 |

Our Corporate Governance Committee is responsible for establishing criteria, screening candidates and evaluating the qualifications of persons who may be considered for service as a Director.

| 1 | SUCCESSION PLANNING | |

Our Corporate Governance Committee considers the current and long-term needs of our business and seeks potential candidates in light of evolving needs, current Board structure, tenure, skills, experience, and diversity.

| 2 | IDENTIFICATION OF CANDIDATES | |

|

The Committee may identify potential candidates from three sources:

| suggestions from current Directors and executive officers; |

| firms that specialize in identifying director candidates; and/or |

| as discussed below, candidates recommended by shareholders. |

| THRESHOLD QUALIFICATIONS | ||

The Committee believes that, at a minimum, nominees for Director must have:

| a demonstrated ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company; and |

| an impeccable record and reputation for honest and ethical conduct in both professional and personal activities. |

| ADDITIONAL QUALIFICATIONS | ||

|

The Committee strives to build a diverse Board that is strong in its collective knowledge. Among other skill sets, the Committee looks for nominees with experience in the following areas:

|

|

|

In addition, the Committee considers such factors as values and disciplines, ethical standards, diversity, and background, within the context of the characteristics and needs of the Board as a whole in nominating Directors.

| MEETING WITH CANDIDATES |

2020 Proxy Statement 9

Corporate Governance Matters

14 Aflac Incorporated

Corporate Governance Matters

The Compensation Committee

| CORPORATE GOVERNANCE MATTERS | 2022 PROXY STATEMENT | 25 |

| The Compensation NUMBER OF MEETINGS IN 2021 5 |  |  |  | |||||

Joseph L. | Georgette D. | Katherine T. | ||||||

Responsibilities

| ● | reviewing and approving compensation levels, equity-linked incentive compensation, and annual incentive awards under the Company’s Management Incentive Plan; | ||

| ● | reviewing, at least annually, the goals and objectives of the Company’s executive compensation plans; | |||

| ● | evaluating annually the performance of the CEO with respect to such goals and objectives and determining the appropriate compensation level; |

| ● | evaluating annually the performance of the Company’s other executive officers in light of such goals and objectives and setting their compensation levels based on this evaluation and the recommendation of the CEO; |

| ● | viewing the Company’s incentive compensation programs to determine whether they encourage excessive risk taking, and evaluating compensation policies and practices that could mitigate any such risk; and |

| ● | reviewing the Company’s general compensation and benefit plans to ensure they promote our goals and objectives.

|

The Compensation Committee may delegate power and authority to any subcommittees as the Compensation Committee deems appropriate.

Compensation Committee Interlocks and Insider Participation. No member of the Compensation Committee is a current or former employee or officer of the Company or any of its subsidiaries. During 2021, no Director was an executive officer of another entity on whose compensation committee any executive officer of the Company served. In addition, no member of the Compensation Committee had any relationship requiring disclosure under the section titled “Related Person Transactions” in this Proxy Statement.

2020 Proxy Statement 15

Corporate Governance Matters

The Corporate Development Committee

| The Corporate Committee NUMBER OF MEETINGS IN 2021 3 |  |  |  | ||||||

| W. Paul Bowers (Chair) | Thomas J. Kenny | Joseph L. Moskowitz | |||||||

Responsibilities

| ● | reviewing the Company’s corporate and strategic organizational development to identify, evaluate, and execute on appropriate opportunities that could enhance long-term growth and build shareholder value; | ||

| ● | assisting the Board in reviewing, evaluating, and approving specific strategic plans for corporate development activities, including mergers, acquisitions, dispositions, joint venture, marketing and distribution arrangements, and strategic equity investments; |

| ● | assisting the Board in reviewing proposals to enter new geographic markets; |

| ● | reviewing corporate development proposals prepared by the Company’s officers and managers and other strategic projects as determined by the Board to ensure consistency with the Company’s long-term strategic objectives; and |

| ● | assisting the Board in monitoring the nature of investments made as part of Aflac Ventures in both the U.S. and Japan, including the Company’s overall corporate venture capital strategy. |

16 Aflac Incorporated

Corporate Governance Matters

The Corporate Governance Committee

| AFLAC INCORPORATED | CORPORATE GOVERNANCE MATTERS |

| The Corporate Governance Committee NUMBER OF MEETINGS IN 2021 3 |  |  |  |  | ||||

| Melvin T. Stith (Chair until May 2, 2022) | Nobuchika Mori | Barbara K. Rimer, DrPH | Katherine T. Rohrer | |||||

Responsibilities

| ● | selecting individuals qualified to serve as Directors to be nominated to stand for election to the Board; | ||

| ● | recommending assignments to the Board’s standing committees; | |||

| ● | advising the Board with respect to matters of Board structure, composition, and procedures; |

| ● | developing and recommending to the Board a set of corporate governance principles applicable to the Company; |

| ● | monitoring compliance with the Company’s political participation program; |

| ● | overseeing the evaluation of the Board; and |

| ● | ensuring that the Company’s management and succession plans are appropriate. |

2020 Proxy Statement 17

Corporate Governance Matters

The Corporate Social Responsibility and Sustainability Committee

Social Responsibility and Sustainability Committee NUMBER OF MEETINGS IN 2021 3 |  |  |

|  | ||||

Barbara K. Rimer,  | W. Paul Bowers  | Thomas J. Kenny  | Melvin T. Stith (until May 2, 2022) | |||||

Responsibilities

CORPORATE SOCIAL RESPONSIBILITY

| ● | overseeing the Company’s policies, procedures, and practices with respect to corporate social responsibility and sustainability, recognizing that these goals and initiatives vary widely among industries, organizations and geographies, in the context of what is appropriate and relevant to the Company, our people and the communities we serve; |

| ● | monitoring and reviewing the impact of the Company’s activities on customers, employees, communities, and other stakeholders in light of the Board’s fundamental duty to preserve and promote long-term value creation for the Company’s shareholders; |

| ● | reviewing the Company’s annual |

| ● | monitoring and reviewing the Company’s support of charitable, educational, and business organizations. |

SUSTAINABILITY

| ● | monitoring and reviewing the Company’s policies, procedures, and practices related to corporate social responsibility and sustainability in light of the Company’s intent to foster the sustainable | ||

| ● | reviewing the goals and objectives of the Company’s environmental stewardship policy, and amending or, to the extent an amendment requires Board approval, recommending that the Board amend, these goals and objectives if the Committee deems appropriate; and | ||

| ● | reviewing the Company’s communication and marketing strategies related to sustainability. |

18 Aflac Incorporated

* We believe “sustainable growth” means being able to meet the needs of our shareholders and customers while taking into account the needs of future generations, and also ensuring the long-term preservation and enhancement of the Company’s financial, environmental, and social capital.

Corporate Governance Matters

The Executive Committee

| CORPORATE GOVERNANCE MATTERS | 2022 PROXY STATEMENT |

| The Executive Committee NUMBER OF MEETINGS IN 2021 3 |  |  |  |  |  | |||||

| Daniel P. Amos (Chair) | W. Paul Bowers | Karole F. Lloyd | Joseph L. Moskowitz | Melvin T. Stith (until May 2, 2022) | ||||||

|

| |||||||||

2020 Proxy Statement 19

Corporate Governance Matters

The Finance and Investment Committee

Responsibilities

PURPOSE

During the intervals between meetings of the Board, the Executive Committee may exercise all of the powers of the Board that may be delegated under Georgia law.

COMPOSITION

Under the Company’s Bylaws, the Executive Committee must consist of at least five Directors, including those Directors who are officers of the Company, and such additional Directors as the Board may from time to time determine. Currently, the

membership of the Executive Committee also includes the Chairs of the Audit and Risk, Compensation, and Corporate Governance Committees, and includes the Company’s Lead Non-Management Director. The Chairman of the Board (or another member of the Executive Committee chosen by him) is the Chairman of the Executive Committee. Effective May 2, 2022, the Corporate Governance Committee has recommended that Dr. Katherine T. Rohrer join the Executive Committee to coincide with her becoming the Chair of the Corporate Governance Committee.

and Investment |  |  |  |  | ||||

Thomas J. Kenny (Chair) | Daniel P. Amos  | Toshihiko Fukuzawa

| Karole F. Lloyd

| |||||

Responsibilities

FINANCE RESPONSIBILITIES

| ● | reviewing and reassessing significant financial policies and matters of Treasury and corporate finance, including the Company’s overall capital structure, dividend policy, share repurchase program and liquidity, and the issuance or retirement of debt and other capital securities; |

| ● | reviewing and providing guidance to the Board on significant reinsurance transactions and strategies; |

| ● | reviewing and reassessing the Company’s overall hedging strategy, including foreign exchange and cash flow hedging, and ensuring proper governance over policies and procedures associated with trading in derivative instruments; |

| ● | in partnership with the Compensation Committee, overseeing the Company’s processes for managing the finances of the employee pension and defined contribution benefit plans, including the related investment policies, actuarial assumptions, and funding policies; |

| ● | in partnership with the Audit and Risk Committee, reviewing and providing guidance on the Company’s corporate insurance |

INVESTMENT RESPONSIBILITIES

| ● | in partnership with the Corporate Social Responsibility and Sustainability Committee, review and provide guidance on corporate social responsibility and sustainability factors relating to issuance and application of proceeds of sustainability bonds and other social and/or sustainability-oriented debt of the Company. |

INVESTMENT RESPONSIBILITIES

| ● | overseeing the investment process and the policies, strategies, and programs of the Company and its subsidiaries relating to investment risk management; |

| ● | periodically reviewing and assessing the adequacy of the Global Investment Policy of the Company and its subsidiaries, and approving any changes to that policy; |

| ● | reviewing the performance of the investment portfolios and |

| ● | in partnership with the |

20 Aflac Incorporated

Corporate Governance Matters

| 28 | AFLAC INCORPORATED | CORPORATE GOVERNANCE MATTERS |

The Board met 4 times in 2019,2021, and all Directors attended at least 75% of the meetings of the Board and the committees on which they served. It is Company policy that each Director should attend the Annual Meeting. All Directors serving at the time attended the 20192021 Annual Meeting.Meeting, which was held virtually due to the COVID-19 pandemic.

BOARD RESPONSIBILITIESBoard Responsibilities

Enterprise-WideOversight of Risk

Board of Directors Our Board oversees our enterprise-wide risk management system, which is designed to achieve organizational and strategic objectives, improve long-term performance, and enhance shareholder value. The Board must understand the risks the Company faces and the steps management takes to manage those risks as well as what level of risk is appropriate for the Company. Our Directors are equipped to make all of these determinations because they are integral to the process of setting the Company’s business strategy. The Board oversees the risk-management process in conjunction with several Board and management committees, each with varying aspects of enterprise risk management as part of their responsibilities. | ||||||

| ||||||

AUDIT AND RISK COMMITTEE Under its charter, the Audit and Risk Committee’s responsibilities include risk management and compliance oversight. | ||||||

● discusses guidelines and policies governing the process by which senior management and the relevant departments of the Company assess and manage exposure to risk, as well as the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures; ● reviews the Company’s risk assessment and enterprise risk-management framework, including risk-management guidelines, risk appetite, risk tolerances, key risk policies, and control procedures; ● reviews critical regulatory risk-management filings and enterprise risk-management material shared with regulators and rating agencies; | ● reviews the general structure, staffing models, and engagement of the Company’s risk governance departments and practices; ● reviews the Company’s major financial risk exposures and evaluates processes and controls that management has adopted to monitor and manage those risks; ● meets in executive session with key senior leaders involved in risk management; | ● reviews with the internal auditors, the independent auditor, and the Company’s financial management team the adequacy and effectiveness of our internal controls, including information security policies and internal controls regarding information security, and any special steps adopted in light of material control deficiencies; and ● reports to the Board, at least annually, with respect to matters related to key enterprise risks and risk management areas of concentration. | ||||

FINANCE AND INVESTMENT COMMITTEE The Finance and Investment Committee oversees the investment process and investment risk management of the Company and its subsidiaries by monitoring investment policies, strategies, and transactions and reviewing the performance of the investment portfolio and overall capital and liquidity position of the Company. Specific risk oversight responsibilities include: | ||||||

● Investment risk Includes liquidity risk, market risk, and credit risk. ● Liquidity risk When an investment is not marketable and cannot be bought or sold quickly enough to prevent or minimize a loss. | ● Market risk The risk that market movements will cause fluctuations in the value of our assets, the amount of our liabilities, or the income from our assets. ● Credit risk The risk of loss arising from the failure of a counterparty to perform its contractual obligations. | ● Enterprise: Capital & Liquidity risk Review of enterprise capital adequacy, access to capital, and maintenance of liquidity position to protect credit ratings and the Company’s ability to meet short and long-term obligations. | ||||

COMPENSATION COMMITTEE The Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with the Company’s business strategy. Specific risk oversight responsibilities include reviewing the Company’s incentive compensation arrangements to determine whether they encourage unnecessary or excessive risk-taking, reviewing at least annually the relationship between the Company’s compensation and risk management policies and practices, and evaluating compensation policies and practices that could mitigate any such risk. As more fully discussed in the Compensation Discussion and Analysis section of this Proxy Statement, the Compensation Committee establishes incentive compensation performance objectives for management that are directly linked to the Company’s results, aligned with shareholder interests, and realistically attainable so as not to encourage excessive risk taking. | ||||||

| CORPORATE GOVERNANCE MATTERS | 2022 PROXY STATEMENT | 29 |

Spotlight on Information Security Risk Oversight The Board has adopted an information security policy directing management to establish and operate an information security program with the goal of ensuring that the Company’s information assets and data, and the data of its customers, are appropriately protected. The Board has delegated oversight of the Company’s information security program to the Audit and Risk Committee. The Company’s senior officers, including its Global Security and Chief Information Security Officer, are responsible for the operation of the information security program and communicate quarterly with the Audit and Risk Committee on the program, including with respect to the state of the program, compliance with applicable regulations, current and evolving threats, and recommendations for changes in the information security program. The information security program also includes a cybersecurity incident response plan that is designed to provide a management framework across Company functions for a coordinated assessment and response to potential security incidents. This framework establishes a protocol to report certain incidents to the Global Security and Chief Information Security Officer and other senior officers, with the goal of timely assessing such incidents, determining applicable disclosure requirements and communicating with the Audit and Risk Committee. The incident response plan directs the executive officers to report certain incidents immediately and directly to the Lead Non-Management Director. For more information, see the Aflac Incorporated Cybersecurity Disclosure at investors.aflac.com under the “Sustainability” tab. |

Pandemic Risk Oversight

Our Board oversees an enterprise-wide approachAt the onset of the pandemic, the majority of the Company’s employees in Japan and the U.S. shifted to risk management designedremote working environments. Both Aflac Japan and Aflac U.S. have taken measures to achieve organizationaladdress employee health and strategic objectives,safety and increase employees’ ability to develop and maintain more flexible working conditions, including return to office efforts if warranted by local conditions. The Company established command centers to monitor and communicate on developments, and operations have remained stable throughout the pandemic. The Company also took prompt action at the beginning of the pandemic to strengthen its capital and liquidity position, and it continued to undertake de-risking activity in its investment portfolios to adjust to market conditions. Both Aflac Japan and Aflac U.S. also accelerated investments in digital initiatives to improve long-term performance,productivity, efficiency and to enhance shareholder value.customer service over the long term. The Board maintained oversight over each of these initiatives, including through certain Board members attending global management meetings as well as formal reports by management at meetings of the Board, the Audit and Risk management requires more than just understanding the risks we faceCommittee and the steps management takes to manage those risks. The Board also must understand what level of risk is appropriate forFinance and Investment Committee throughout the Company. Our Directors are equipped to make all of these determinations because they are integral to the process of setting the Company’s business strategy.pandemic.

While the Board oversees the risk-management process generally, several Board and management committees have specific roles that correspond with their areas of responsibility.

Role of Management The Company’s management is responsible for day-to-day risk management. Our enterprise risk-management framework, which is aligned with and overseen by the Board and its committees, includes several executive management committees whose roles incorporate risk management across the enterprise. For example, executive management’s Global Risk Committee oversees the processes for identifying, assessing, measuring, monitoring,

|

|

The Finance and Investment Committee oversees the investment process and investment risk management of the Company and its subsidiaries by monitoring investment policies, strategies, and transactions and reviewing the performance of the investment portfolio and overall capital and liquidity position of the Company.

Compensation Committee

The Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with the Company’s business strategy. As more fully discussed in the Compensation Discussion and Analysis section of this Proxy Statement, the Compensation Committee establishes incentive compensation performance objectives for management that are realistically attainable so as not to encourage excessive risk taking.

Code of Business Conduct and Ethics

The Company’s Code of Business Conduct and Ethics applies to all Directors, executives, and employees of the Company and its subsidiaries. In addition, there are provisions specifically applicable to the Chief Executive Officer, the Chief Financial Officer, and the Chief Accounting Officer. The Company intends to satisfy any disclosure requirements regarding amendments to, or waivers of, any provision of the Code of Business Conduct and Ethics by posting such information on our website, aflac.com, under “Investors,” then “Governance,” then “Governance Documents.”

Chief Executive Officer and Executive Management Succession Planning

The Board, in coordination with the Corporate Governance Committee, is responsible for succession planning for key executives to ensure continuity in senior management. As part of that effort, the Board and the Corporate Governance Committee ensure that the Company has an appropriate process for addressing Chief Executive Officer succession as a matter of regular planning and in the event of extraordinary circumstances.

22 Aflac Incorporated

Corporate Governance Matters

The Chief Executive Officer plays an active role in the succession-planning process for other executive management positions. In coordination with the Company’s executive management team, including the General Counsel and the Director of Human Resources, the Chief Executive Officer periodically evaluates potential successors, reviews development plans recommended for such individuals, and makes recommendations to the Corporate Governance Committee. Together these parties also identify potential successors for other critical executive management positions. In addition, the Chief Executive Officer reviews executive succession planning and management development at an annual executive session of independent Directors.

The Board oversees and monitors strategic planning. Business strategy is a key focus at the Board level and embedded in the work of Board committees. In addition to strategic plans being reviewed by the Board annually, the Boards hold periodic retreats in the U.S. and Japan focused on strategic development, and the Corporate Development Committee reviews strategy with respect to non-organic investment considerations. The Board believes that overseeing and monitoring strategy is a continuous process and takes a multilayered approach in exercising its duties.

Commitment to Corporate Social Responsibility and Sustainability

Corporate Social Responsibility and Sustainability Governance

| ● | Our Board committees play critical ESG oversight and leadership roles through their efforts to identify, promote, and monitor responsible and ethical corporate governance mechanisms, corporate social responsibility and sustainability goals, ESG-related compensation programs, and risk management policies that identify and assess climate-related risks. |

| ● | The Corporate Social Responsibility and Sustainability

|

| ● | The Corporate Social Responsibility and Sustainability Committee coordinates with (a) the Finance and Investment Committee regarding guidance on CSR and sustainability factors relating to issuance and application of proceeds of sustainability bonds and other social and/or sustainability oriented debt of the Company and oversight of the investment process, (b) the Compensation Committee relating to incorporating CSR and sustainability factors into executive compensation programs, and (c) the Corporate Governance Committee to incorporate diversity, equity, and inclusion efforts with regards to the Company’s policies and principles relating to succession planning and management development. The Audit and Risk Committee oversees the Company’s policies, process, and structure related to enterprise risk engagement and management, which includes ESG risks and opportunities. |

| ● | The Board, through |

2021 Key Corporate Social Responsibility and Sustainability Initiatives

Throughout the year, the Corporate Social Responsibility and Sustainability Committee monitored the progress of the five 2021 ESG Modifier objectives in the following categories: responsible investing, carbon neutrality and net zero emissions, diversity and inclusion, sustainability bond, and advanced reporting and disclosure. See the “Compensation Discussion and Analysis” section of this document for more discussion on these items.

Human Capital Management